Private Equity in 2020 in Three Charts

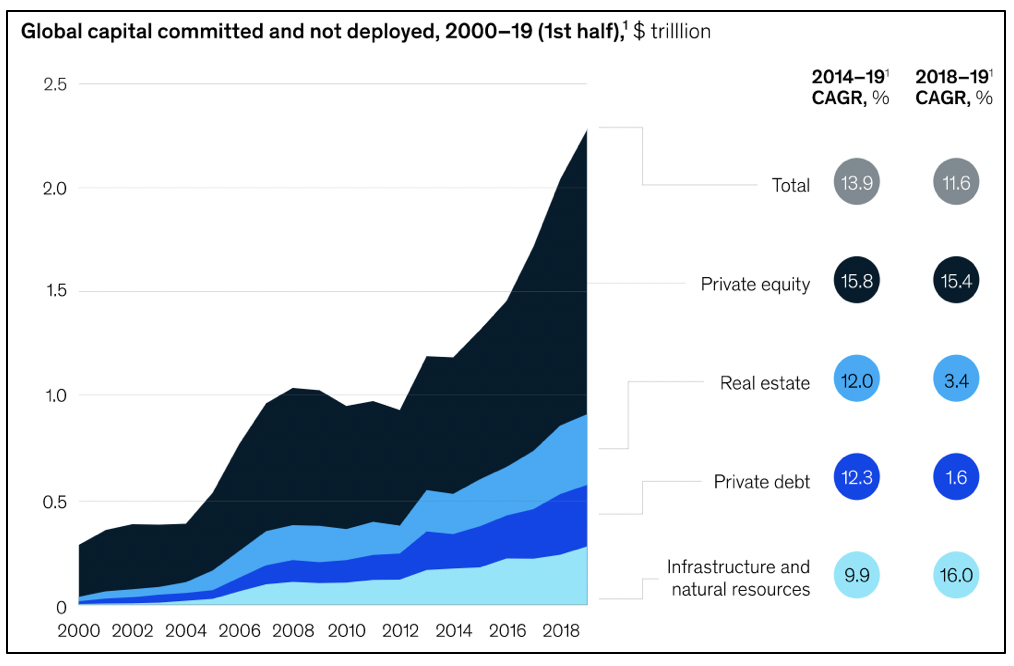

When capital markets are more flush than ever with cash …

Source: McKinsey & Co.

Source: Bain & Co.

prices are driven up…

resulting in exit multiples remaining stable despite improving revenue, margins and multiples!

Wait. That makes no sense!

More money than ever pushing prices up yet exit multiples remain flat – what’s going on?

Source: Bain & Co.

No revenue growth, no margin expansion, no multiple expansion

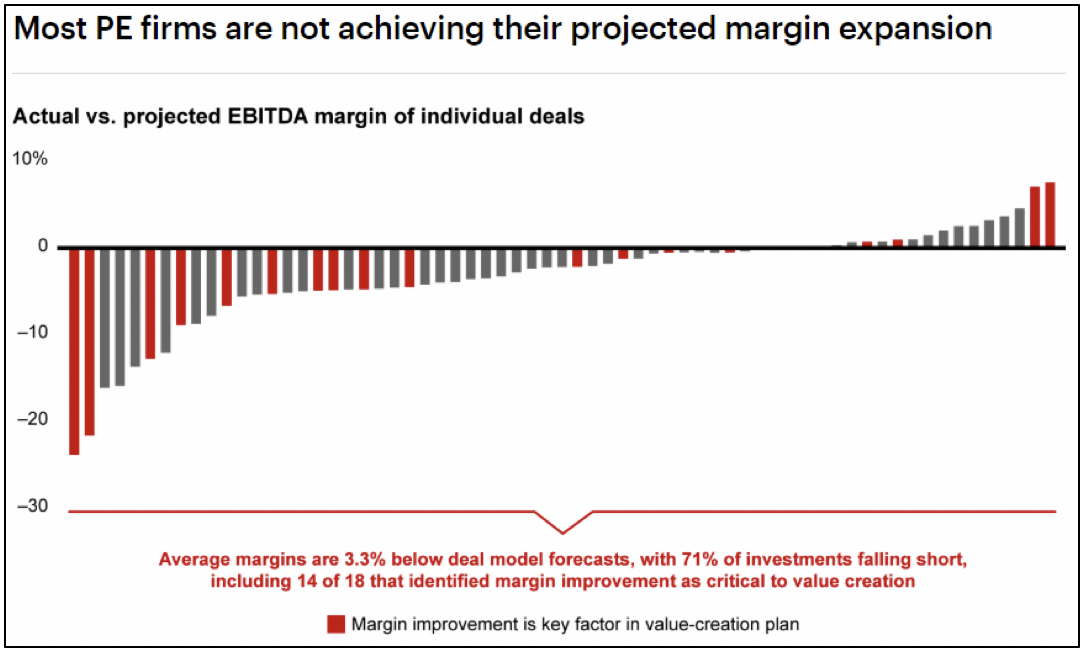

Most private equity firms are reducing their estimates of multiple expansion given the worsening macroeconomic trends and decade-long secular trend of increasing deal multiples, and as revenue growth slows or reverses in a soft economy, the two primary drivers of incremental deal value are compromised. And because 71% of deals fail to deliver margin expansion even when margin expansion is a key driver of expected performance (see Bonus Chart 1 below), all three legs of the growth engine are compromised.

Bonus Chart 1 (Source: Bain & Co.)

What this means for you

What does this mean for US and international small to medium sized businesses? First, with all of the committed cash on the sidelines, investors are going to be hungry for deals – they will be spending. Many institutional investors may choose to delay investment decisions or make more opportunistic investments and acquisitions as economic conditions deteriorate (BTW, opportunistic is often a euphemism for distressed – as a business owner you do not want to be in this category – ever). You can expect longer due diligence periods and attempts to renegotiate deal terms as your deal moves from indication of interest (IOI) to letter of interest (LOI) to term sheet to subscription agreement or purchase and sale agreement. Having an experienced guide to insulate you from as much of the back and forth as possible, allowing you to focus on continued peak performance of your business is critical. We saw these things occur during the 2008-2010 Great Recession and other periods of economic turmoil. Turmoil and the uncertainty it breeds are not your friend. The right guide will get you safely over the whitewater so you can enjoy the view from the other side.

Congratulations on reading this far - here’s a second bonus chart to reward you for your effort. If you have sensed that private equity has grown to be a more significant part of the global financial picture than public equities (stocks that are publicly traded on exchanges like the New York Stock Exchange or NASDAQ), you are right:

Bonus Chart 2 (Source: McKinsey & Co.)

Private equity is now nearly four times larger than public equity yet world financial markets revolve around public equities. Ironically, initial public offerings (IPOs) are still a favorite exit strategy for large private equity firms. So don’t panic when you see markets gyrating. The median holding period for private equity investments is 4.3 years (Source: Bain). A well-run business will navigate the turmoil and probably emerge stronger having had to make tough decisions about every aspect of the business.

Vertical Capital Advisors can help your business plan and execute strategies that enable your enterprise to thrive in all market conditions. It’s not too late to plan. Call us today.

* * *

ABOUT VERTICAL

Vertical Capital Advisors is an Atlanta-area boutique investment banking firm built on creating tangible value for our clients, serving clients in just about every industry. Our clients are both capital growers and capital allocators. How can Vertical help your firm maximize value?

Joe Briner

Managing Director

Vertical Capital Advisors LLC

briner@verticalcapitaladvisors.com

866-912-9543 ext 108

678-591-0273